What are floor clauses?

It is no coincidence that all the media are talking nonstop about floor clauses and you probably may be wondering what it is. These clauses have affected to about 2 million people in Spain, so, as if you have a mortgage contract as if not, you probably want to know more about the topic.

This is all the information you need to know to understand what are the floor clauses.

What is a floor clause?

It is a clause in which the bank sets the minimum the variable interest rate that must be paid on the mortgage can reach. This means that the client will always pay the interest at the fixed rate of minimum interest filed by the bank even if the reference index gets lower.

Main problem

You have to pay a minimum fixed regardless of how the reference index evolves, so you’ll not be able to take advantage of the moments in which the index is below your minimum limits because of the floor clause that has been imposed to you from the bank, which translates into an increase of the monthly mortgage.

Reference index: What is the Euribor?

The reference index is what will determine if your variable interests increase or decrease. The most common reference index is Euribor, although there are others such as the IRPH, IRS, or Mibor

Euribor is the interest rate applied to transactions between banks in Europe, in other words, the percentage the banks pay as the rate when another bank lends them money. The average to which European banks lend money is what determines the Euribor you’ll have to pay.

What are the variable interests?

Variable interests are those that are determined by two components: the reference index agreed with the bank, and the differential, a fixed part that must be added to the reference index. When banks grant a credit, as a general rule, they require in the return of the payment the Euribor (if its the reference index agreed) plus the differential. A loan to euribor+1 means having the interests of euribor and an extra point.

Then, should you be paying less?

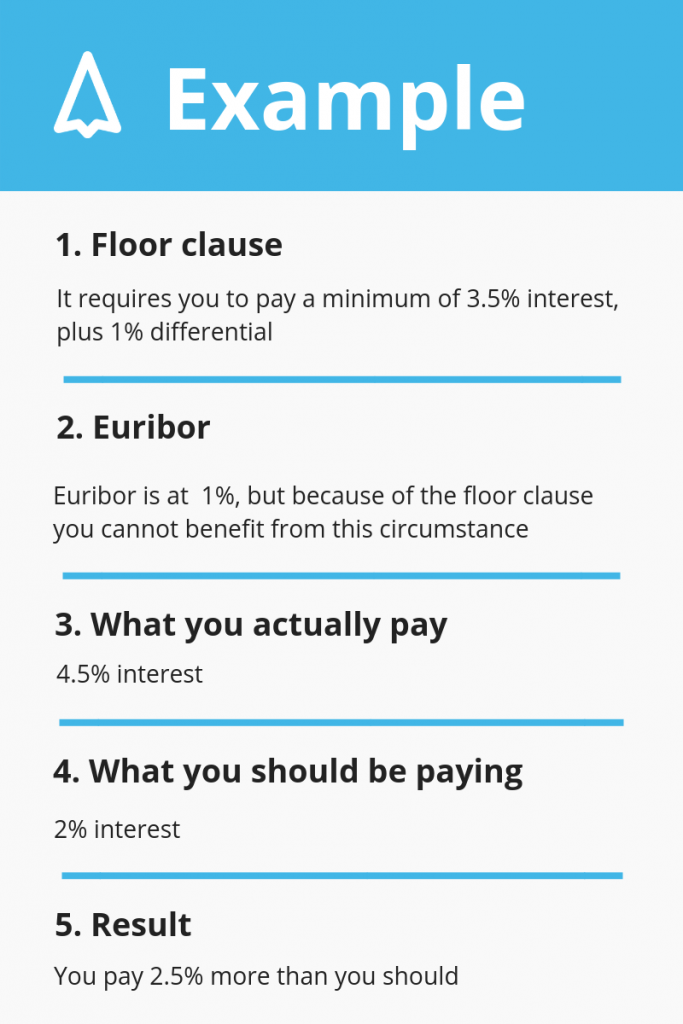

Let’s use an example: in your mortgage contract there is a floor clause in which the minimun limit to pay variable interest is 3.5%, plus a differential of 1% to such interests. There will be certain periods in which the Euribor will be at an interest rate lower than the limit; for example, to 1%. But the floor clause won’t let you take advantage of this circumstance, and you’re paying a 3.5% plus 1% of the differential; in other words, a 4.5%, when you should be paying just that 1% indicated in the Euribor plus 1% of the differential, that is, 2%. So yes, the bank is making you pay something that you should not.

Any doubts?

You can find more information about what are floor clauses in our legal guides , and if you think that you are one of the damaged in Spain, you can sign in legalbono where you can start your claim and recover in a quickly and simple way what belongs to you.

Start your claim now, it’s free!